exaggerating ag data—what is the impact?

mismatched ag data sow doubt

massaged data distorts markets and causes errors

effective trade and investment need transparency

A matter-of-fact analysis by Gao Shanwen 高善文, SCIC Securities chief economist, on 3 December, reignited debate about data credibility. He highlighted three anomalies

post-COVID GDP growth was abnormally higher than indicators (fixed asset investment, retail sales) that lagged

official urban unemployment—steady at some 5 percent since mid-2023—belied a catastrophic labour market, masked by the return of labourers to their rural homes for lack of work in urban centres

inflation metrics, typically tied to GDP trends, deviated seriously from established patterns in 2023 and 2024

Gao’s critique applies across many macroeconomic metrics. Agriculture is a glaring case in point. Official figures aim to serve policy narratives, and cognitive dissonance is par for the course.

Provincial and national grain figure mismatches as long ago as 2005 forced the NBS (National Bureau of Statistics) to admit collection errors. The first ‘No. 1 Document’ (2013) of Xi’s administration prioritised food security and farmland preservation. State media lauded record output, at odds with accounts of abandoned harvests and surplus grain rotting in storage.

Such discrepancies obscure systemic challenges and risk misaligning policy initiatives with actual conditions, contends Li Guoxiang 李国祥, CAAS (Chinese Academy of Agricultural Sciences).

yielding to scrutiny

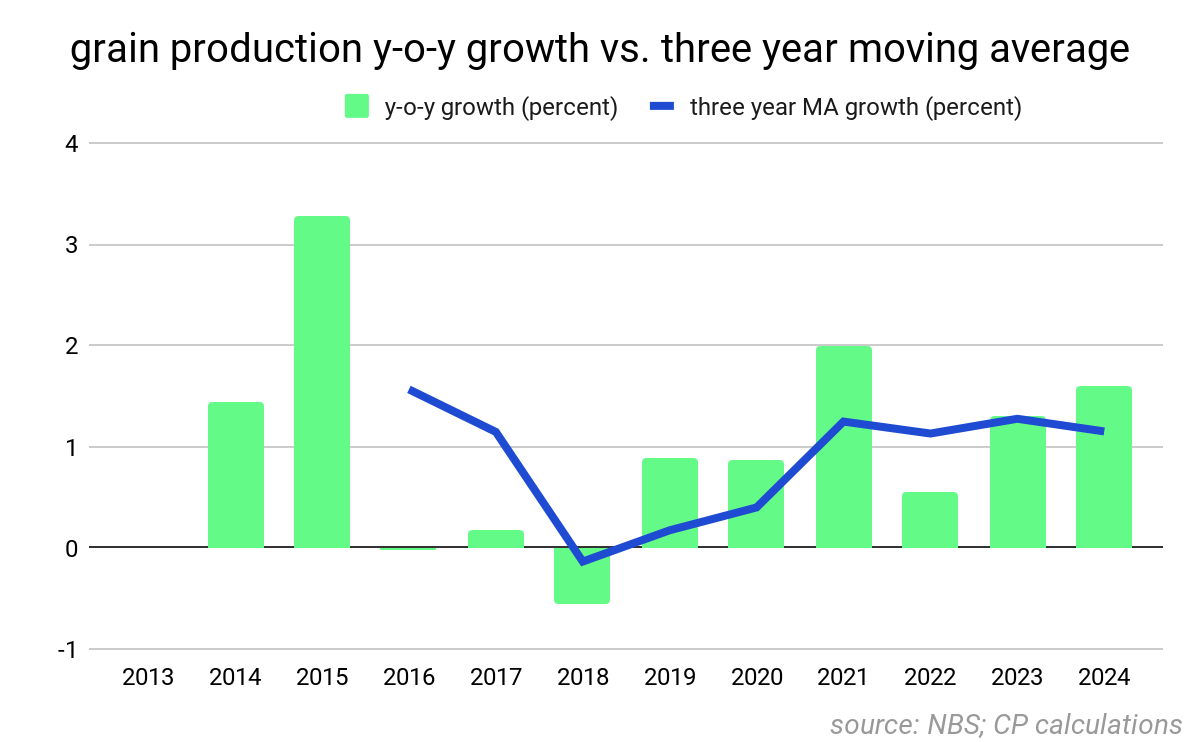

Grain output rose 1.3 percent year-on-year to 695.41 million tonnes in 2023, rising by 1.6 percent to 706.50 million tonnes in 2024, continuing its long-term upward trajectory. The 2023 figure was some 0.8 percent above the baseline trend. 2024 topped the baseline by 1.64 percent. Official statistics in 2023 and 2024 outpaced expectations based on historical patterns.

This expectation-beating record total came despite damaging rainfall during harvests in the Huang-Huai region. Localised flooding in the northeast inundated over 10 million ha in Heilongjiang alone, reported CAAS.

Smoothing over these setbacks, national data massaged output figures in line with policy narratives of resilience and food security argued a 2023 National Academy of Sciences analysis.

Henan, a critical grain-producing province, demonstrates the disconnect between regional and national reporting. In 2023, it produced 662.43 million tonnes, with an average yield of 6,142 kg/ha despite unseasonal summer rains dragging down the harvest. Central authorities admitted only a modest 1 percent loss. Yet in 2024, output rose to 671.94 million tonnes, with Henan’s average yields reaching 6,234.8 kg/ha. This came despite the worst drought in a decade, with a mid-June heatwave reaching 42°C.

These setbacks aside, NBS logged a 2.5 percent year-on-year increase in Henan’s summer harvest, attributing 65 percent of national harvest growth to the province. Henan’s prominence in official growth figures raises questions about whether other regions’ losses were downplayed to sustain the narrative of resilience.

Record harvests were again touted in 2024, surpassing 700 million tonnes for the first time and exceeding baseline projections by nearly 5 million tonnes. Yet localised data painted a stark contrast. In southern Shandong, northern Anhui, and eastern Henan, extreme weather reduced yields by up to 70 percent, with some areas suffering total crop failure. The northeastern corn belt was deluged, though crop rotations were credited with stabilising planted areas.

Year-on-year growth rates fluctuate in the short term, yet the three-year moving averages show only a marginal decline into 2024. This suggests that official data smoothing may have offset harsher regional damage.

Genuine improvement in ag infrastructure and technique helps build the long-term upward curve. But unvarying growth figures ‘risk exaggerating production levels’, warned Economic Observer in November 2024. Such hype can misalign supply estimates and policy decisions, making markets inefficient.

Distortions have tangible consequences, an Anhui official conceded in April, admitting conflicts between official production targets and local priorities. Echoing the concern in June, COFCO confirmed that glitchy grain production and consumption data harms producers and consumers alike, above all as farmers face falling prices and rising costs.

soybean pressure

A lynchpin of PRC ag trade, soybean imports remain a barometer of its global dependency. Yet official numbers continue to reflect smoothing efforts that blur this reliance—for all the state’s claims of boosting domestic production.

Import numbers were massaged downward from 91.08 to 89.22 million tonnes in 2022. Domestic production rose by just 600,000 tonnes in 2023, dwarfed by a reported 10.2 million-tonne import surge.

GAC (General Administration of Customs) reported 2023 imports at 99.41 million tonnes, an 11.4 percent year-on-year rise. Cumulative monthly figures, however, revealed imports of 101.71 million tonnes, a gap of over 2 million tonnes.

The revisions keep imports suspiciously under the symbolic 100-million-tonne threshold, even as global dependence on imports remains high.

Farmers struggling to compete are not reassured. A Heilongjiang grower lamented to Farmers' Daily that imports are often cheaper and of better quality than domestic varieties.

Consumption data, too, are doubted. Soybean meal use apparently dropped 11.8 percent in 2023, reports the Feed Industry Association. Reflecting state directives for feed formulas to use less soy. But the sharp rise in imports casts shade. Excess volumes were, speculate COFCO analysts, redirected into state stockpiles to stabilise domestic prices.

Data transparency would enhance market stability and reduce uncertainty for global producers and traders, agrees the WTO.

urban illusion, rural refuge

An exodus to cities and towns has long shaped rural labour markets. Stagnating urban jobs between 2021 and 2023 reversed this trend. Declining job opportunities drove an estimated 41.74 million workers back to villages, Gao Shanwen notes. Official statistics did not reflect ground reality.

This rural reflux is barely reflected in national statistics (which exclude rural and informal labour). The official urban unemployment rate, steady at 5 percent since mid-2023, is kept artificially low by excluding the displaced.

Official jobless figures typically understate its extent, above all in the countryside, where informal and seasonal employment is prevalent, notes Li Shi 李实, Zhejiang University Institute for Common Prosperity and Development.

Workers returning to rural areas may mean several things. They may convey new skills and capital to their communities, but also tougher competition for jobs and resources, argues Wang Meiyan 王美艳, CASS (Chinese Academy of Social Sciences) Institute of Population and Labour Economics.

These shifts are, however, obscured by data massaged to align with policy narratives rather than reality, claims Gao.

what the husk? stripping down to the grain

Grain production may indeed be on the rise, yet soybean imports remain high, and data inaccuracies undermine resilience. The PRC should share more data on ag production, transport, and storage, argues China Logistics and Transportation Review, helping firms operate optimally and ease risk.

Dodgy data harms domestic resilience, and its ripple effects extend globally. The FAO notes that the PRC's demand for soybeans impacts global prices and trade flows, and transparency is essential to easing volatility. A Brazilian soybean exporter told Reuters that discrepancies create uncertainty, disrupting trade.

For foreign firms, opaque data is a drag on investment and strategy, limiting assessments of market demand, competition, and regulatory conditions, a European food processing company representative told Food Industry Asia.

Improving transparency requires institutional change, agrees Wang Wei 王微, Development Research Centre Institute for Market Economy. Absent investment in advanced data collection—via remote sensing, big data analytics, and field surveys—the PRC risks the credibility of its ag narrative and its domestic and global advantages.

data wonks

Li Guoxiang 李国祥 | Chinese Academy of Social Science research fellow

Credible data, insists Li, is indispensable. Anomalies cause failure to address institutional issues in rural economies; rural revitalisation strategy hinges on it. He adds that inflated production figures obscure the true effects of falling grain prices, rising input costs, etc., threatening smallholder earnings.

State production targets balance uneasily with local realities, not least given ever more extreme weather. Reconciling central, local and national ag statistics makes more advanced data collection and transparency imperative. The point is to identify vulnerabilities, address shortfalls, and achieve sustainability.

As a food security and land reform expert at CASS for over two decades, Li has supported high-level initiatives. Active in grain sector bodies, he saw the Food Security Law through two drafts and passage into law in December 2023.

Gao Shanwen 高善文 | SDIC Essence Futures chief economist

Ironically, the perception of stability can destabilise, notes Gao: overly optimistic figures disconnect official statistics from observed facts. His analysis—highlighting an estimated 41 million post-pandemic shortfall in urban jobs and resulting reflux to the countryside—raises alarms about data credibility.

Broader trends of data manipulation are in play. Official narratives proclaim stability and progress, denying persistent weaknesses. Data must align with reality to inform policy, argues Gao: the current approach is a net risk, harming foreign investment, trade relations, and overall PRC credibility. He urges policymakers to prioritise data accuracy and transparency.

A veteran economist, Gao urges systemic reform in data collection and reporting, blasting the inaccuracy of GDP figures and demanding independent verification. Working at the People’s Bank of China and State Council Development Research Centre before moving to the private sector, Gao focuses on macroeconomic risk, financial stability, and the intersection of policy and market conduct.