food security II: the stress-test ahead

stress points, soft spots, and the shape of resilience

If part one laid the bricks, part two tests the foundations.

Reserves, costs, degraded soils, and climate stress—this half probes the system’s pressure points.

It lifts the lid on Beijing’s evolving resilience logic: not self-sufficiency at all costs, but a system built to bend without breaking.

Some bits are rock solid. Others…less so.

5. buffers not stockpiles

Clause 5 shifts from volume to versatility: can the system hold under pressure?

PRC grain storage capacity tops 700 million tonnes. NFSRA says rice and wheat stocks now exceed one year of demand; loss rates are claimed below 1 percent.

Urban and high-risk areas now maintain 10–15 day finished grain reserves. 6,900 processors offer a daily 1.7 million tonne emergency output. This distributed model—spanning mills, factories, and retailers—has shown strength during shocks.

But quantity masks mismatch.

Ordinary rice surplus hides structural oversupply, warns Li Jianping 李建平, CAAS. Japan’s 'gentan' failure is a cautionary tale.

Real buffer capacity remains unclear, with little independent oversight on reserve quality or turnover.

To address this, the Plan proposes

zoning reserves by variety and end-use

upgrading processing to support high-end and special-use grains

deploying digital spoilage alerts and traceability

clarifying local and central reserve responsibilities

loss prevention as reform strategy

Waste reduction now functions as systemic insurance—grounded in regulations

Food loss rates remain high across the chain—especially at production.

PRC food waste per capita is 93kg/year, reports CAAS (Chinese Academy of Agricultural Sciences), compared to 67 kg in the European Union.

Grain loss hovers between 3 to 5 percent (from natural disasters, pests, and disease) and loss is around five percent for meat and poultry. Fruit and vegetable losses, on the other hand, exceed 25 percent. This is due to poor harvesting, handling, and storage, says CAAS.

Some 15 percent of food is wasted by inefficient processing and packaging. Another 15 percent of perishable foods are lost during distribution and at retail outlets due to poor cold chain infrastructure (China Statistical Yearbook, 2023). A further 15 percent is wasted by households buying too much.

PRC consumers waste an average 17 million tonnes of food each year, found CAS (Chinese Academy of Sciences) in 2023.

Improving storage, transportation and feed technologies will help minimise food loss, argues Ye Xingqing 叶兴庆 former State Council Development Research Center Rural Economic Research director. Even small reductions in food waste, when scaled up, can have significant implications for food security and resource efficiency.

6. squeezed margins, shaken confidence under pressure

It’s not just about what’s grown—but whether farmers can afford to keep growing it.

Production costs continue to outpace returns. Food Security Law (Articles 26-8) require budgetary backing across the production chain, the 2025 No. 1 Document emphasises price stabilisation and minimum purchase price policies.

These tools are already in play: 2024–26 machinery subsidies, cost-income pilots, and interprovincial fiscal transfers all target weak farm margins—but implementation remains uneven.

tight returns

Beijing can boast record-breaking harvests, with this year's output above the 'baseline' again, and smart ag action plans boosted by extensive subsidy programs.

But farmer incomes struggle to keep pace with soaring input costs, and high levels of imports contribute to domestic oversupply and play havoc with food security rhetoric.

2024 net returns fell to C¥200/mu for corn, C¥116 for rice, and near-zero for wheat. Input costs rose 5–10% annually.

Touted as a ‘blue ocean’, the sector remains plagued by oversupply, eroding margins, and systemic inefficiencies, argued Agricultural Industry Watch in November 2024.

The MPP (minimum purchase price) system has provided a floor since 2004, but its reach has been fading. Recent hikes—like the 2024 wheat MPP increase—were met with online incredulity, exposing credibility gaps.

While rice MPP, such as that announced in Henan and Jiangsu in October 2024, has helped stabilise and even increase rice acreages by 8.3 percent between 2004 and 2017. However, artificially inflating grain prices above market-clearing levels, the policy is criticised to result in overproduction and financial strains on government.

cautionary tales

Even with subsidies and MPP, the sector faces deeper inefficiencies.

Around 210 million smallholder farmers manage plots of less than 10 acres, constituting 98 per cent of all farming households and covering 70 percent of the PRC's arable land.

Fragmented land, dispersed operations, and an aging farming population has led to widespread smallholders who struggle to adopt effective farming practices and ultimately find farming profitable, lamented Liu Junjie 刘俊杰, MARA Rural Economy Research Centre researcher in August 2024.

Poor coordination has triggered frequent gluts in fruits and vegetables, depressing prices and undermining confidence.

The Plan signals fatigue with stalling ag modernisation drives

e-commerce expansions faltered due to logistics gaps

infrastructure projects (cold storage, greenhouses) underused or abandoned

big firms (e.g. Evergrande, Alibaba) exited ag at a loss

Modernisation hinges on more than stronger price signals and more predictable returns. Real profitability depends on aligning policy, production, and market response.

7. land limits

Clause 2 reaffirms the land triad: defend the redline, upgrade quality, restore ecology. Supported by Articles 10–17 of the Law and the 2022 Black Soil Protection Law.

three layers of land protection

The Plan consolidates governance around a three-tier system

quantity: the farmland redline is non-negotiable

quality: convert all permanent farmland to HSF by 2035

ecology: expand salt-alkali rehab, conserve black soils

This approach again integrates long-standing targets—like the 80 million ha HSF by 2030 goal—into a coherent protection agenda underpinned by Food Security Law.

But it also sharpens trade-offs: intensified land use can edge out marginal habitats and exacerbate biodiversity loss.

The current HSF paradigm's reliance on chemical inputs is unsustainable, warned sannong champion Wen Tiejun 温铁军 on his Weibo account in 2024.

From degraded to dependable

The northeast black soil region exemplifies the Plan’s ambition.

As outlined in Section 4, field trials in Heilongjiang and Jilin show 5–15 percent yield increases, 10–20 percent fertiliser cuts, and a 0.2–0.3 point rise in soil organic matter.

Rather than listing techniques in full again, the Plan's core bet is clear: group-based interventions—straw management, soil amendment, erosion control—can restore degraded land at scale.

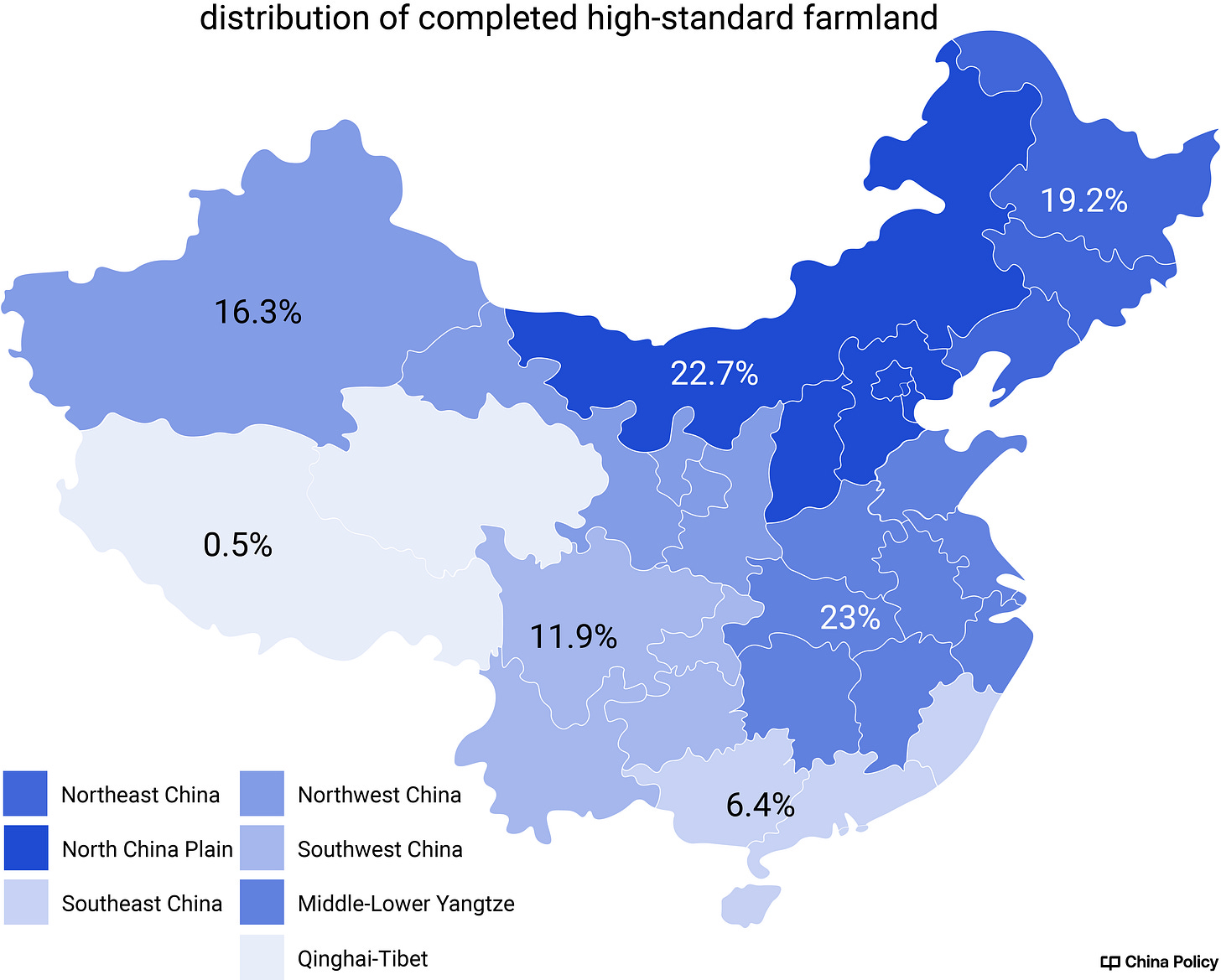

Nationwide, HSF upgrades are being rolled out through the March 2025 implementation plan. These fields are levelled, irrigated, and engineered for resilience, with organic matter improvement campaigns now mainstreamed.

72 million ha of HSF are to be in production by end-2025. But renovation is already underway across many tracts started under the 2021–30 plan, with 10 million ha to be renovated this year and a further 19 million ha by 2030.

The real strain shows in the 2023 MARA–CAU survey: across 28 provinces and seven HSF zones, over 46 percent of new HSF plots already require renovation—cracked irrigation channels, degraded piping, and more.

High chemical intensity is partly to blame.

For all the productivity gains, excessive chemical use undermines long-term fertility, warns Ma Jun 马军,Institute of Public and Environmental Affairs director. Biodiversity collapse will bite back: soil degradation is already forcing many HSF sites into early remediation.

For all Premier Li Qiang’s insistence that grain production will be further strengthened, real investment lags.

Given local government debt obligations and tapering state subsidies, the 2024 average investment of some C¥1,500/mu p.a. is barely half the C¥3,000/mu required to hit 2030 HSF targets, reckons Mou Yiling 牟一凌 China Minsheng’s Chief Strategist.

Soil improvement funding remains thin—less than C¥50/mu in many cases.

limits of intensification

Water scarcity remains a key constraint.

Clause 2 calls for ‘green and efficient water use’, with a focus on precision irrigation, runoff control, and infrastructure upgrades—especially in the northern grain belt.

Ag accounts for 62 percent of PRC total water consumption, exacerbating water scarcity issues in many regions. Inefficient irrigation practices and pollution further worsen the situation, especially in the northern granaries.

Highlighted as a region with high water stress in a 2020 World Resources Institute report, ongoing water scarcity issues in northern China were acknowledged by a 2023 Ministry of Water Resources report.

Large-scale diversions like the South-to-North Water Transfer help, but ecological and financial costs are mounting.

Climate change is already having a major impact, noted Famers Daily in April 2024. Tracking changes from 1961-2020, the warming rate is notably higher in the north and west, with northern winters also becoming warmer. National average rainfall has risen 5.1 mm every decade.

There are some positives, with Farmers Daily crediting these climate changes for expanding corn and rice cultivation areas in Heilongjiang, extended rice growing periods in Jiangxi, and winter wheat expansion in Xinjiang.

But, it concedes, autumn rain increases in the north has led to fruit cracking during the harvest season, affecting yields in the north. In the south, rising temperatures have exceeded the heat tolerance limits of crops, impacting yields.

Heat-resistant crop varieties are in development, particularly rice as it has a 34C critical temperature threshold.

Quite remarkably, after floods the year before, Henan’s summer harvest rebound drove 64 percent of the national increase in 2024, despite the worst drought in a decade, with temps hitting 42°C and roads and highway surfaces topping 62°C.

This was thanks to policy support, heralded a CCTV News. Certainly not smoothing numbers.

An April 2025 report, Timing the Seasons, jointly issued by Greenpeace and Shaanxi Normal University, finds that farming systems in Shaanxi, Chongqing and Hebei are increasingly disrupted by rising temperatures, erratic rainfall and frequent extreme weather.

Traditional self-reliance strategies are proving inadequate as smallholders—lacking capital, insurance and institutional support—struggle to respond to unseasonal frosts, droughts and storms.

More proactive resilience building is needed, argues Liu Juan 刘娟 China Agricultural University associate professor. Climate-related uncertainty is discouraging farmers from reinvesting after damage.

8. resilience by design

Clause 6 shifts the emphasis from self-sufficiency to system design—integrating reserves, risk alerts, and governance levers.

The Plan’s 2035 goal is a system that is ‘‘higher level, higher quality, more efficient, more sustainable’ (更高层次、更高质量、更有效率、更可持续).

In practice, this means not just producing more, but building a governance system that coordinates land, trade, reserves, and research in a coherent whole.

The rice bowl must be held firmly—but with flexibility, not rigidity.

autonomy, not autarky

The core formulation translates to: domestic-first, capacity-secure, strategically importing, and tech-enabled. This structure aims to preserve national control, while acknowledging that imports, if well-managed, can support rather than undermine food security.

Early warning groups, diversified supply chains, and risk protocols are part of the design.

The 2023 early warning expert group and the September 2024 Opinions on a Diversified Supply System provide institutional architecture for risk management.

The soybean crisis, discussed in Section 1, remains the paradigm case: WTO entry, U.S. price dominance, and policy missteps led to lasting import dependence.

Today’s approach includes broader sourcing and investment in domestic seed systems.

Resilience in the face of the Sino-American tariff sage reflects a structural shift in supply and demand management, argued Yicai in May.

But risks persist.

Without better alignment between import policy and domestic price signals, even diversified trade can distort incentives, cautions as Zhu Jing 朱晶 of Nanjing Agricultural University.

During a January roundtable with Heilongjiang officials, processing firms, trade and logistics companies and large-scale farmers, Han Jun 韩俊 MARA Minister, conceded that low market prices and declining profitability for farmers and processors are urgent issues.

from calories to capacity — and from slogans to systems

Food security is now the ultimate systems test. The Plan shows how far Beijing will go—digging deep into land, logistics, and livelihoods.

But whether that scaffolding holds—through flood, frost, or falling prices—will depend on more than plans.

It hinges on trust, traction, and time for a sector that has higher potential but is beset by low confidence.

next up: pillar two

How China plans to win the agri-tech race — not just securing the harvest, but reengineering how it’s grown.